What is Funding Rate?

Perpetual Futures, or perps, have been around since 2016, first introduced by BitMex. Today almost all centralized exchanges have introduced perps. Perpetual Futures, as the name suggests, are futures contracts that do not expire.

Traditional futures markets involve speculating on the price of an asset at a certain expiration date. Hence, futures prices tend to deviate from actual spot prices. As a futures contract nears expiration, the contract price will converge with spot price. On the other hand, perps do not have expiries hence do not have a time value element in its valuation. So how does a futures contract that does not expire mirror its spot price?

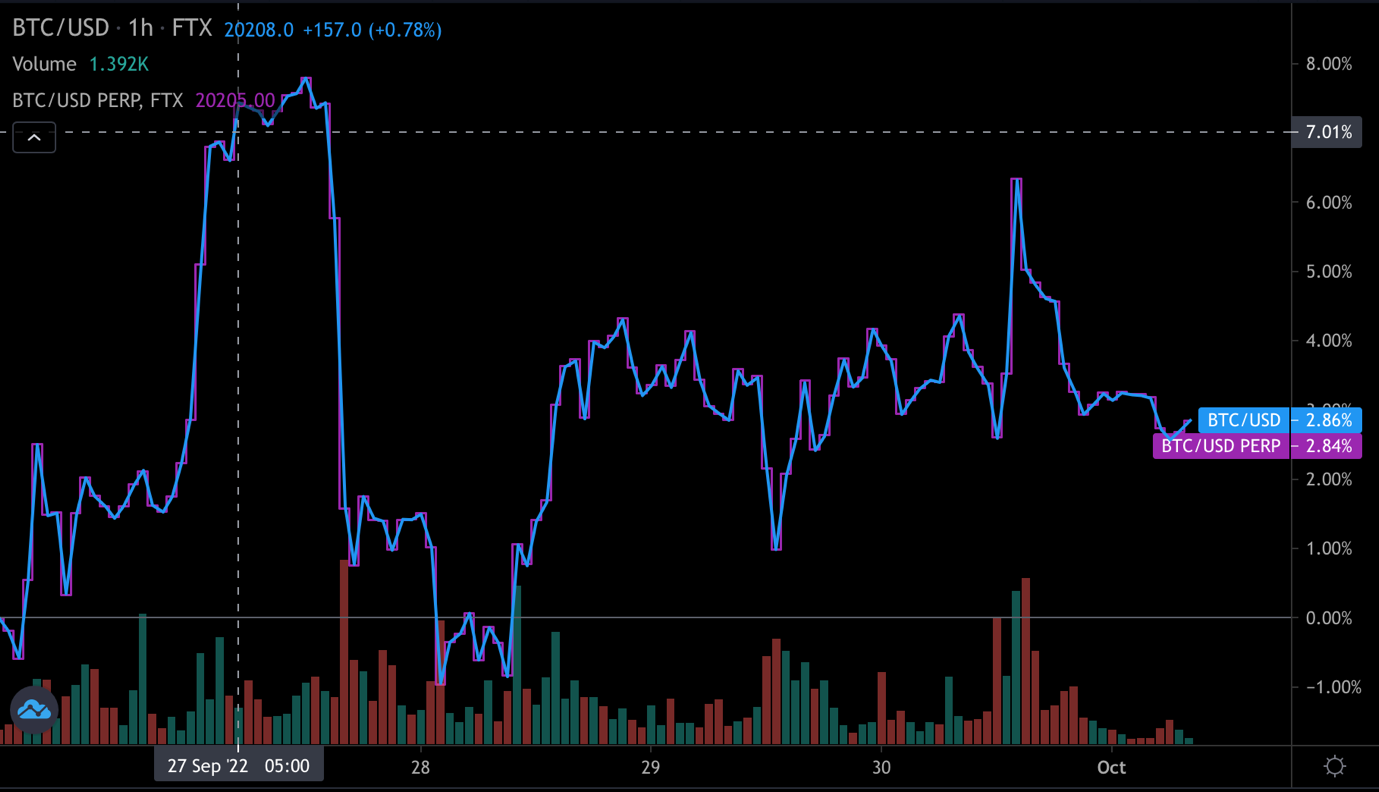

These contracts depend on a feature called funding rates to ensure prices stay as close to its underlying spot price as possible. This can be seen in the chart at how closely a BTCUSD perp contract on FTX follows FTX’s BTCUSD spot market.

Funding rates are essentially periodic payments between long and short traders. When funding rates are positive, long traders pay interest payments to short traders and when funding rates are negative, shorts pay longs. This mechanism ensures that price mirrors the spot market as closely as possible. As prices deviate above the spot price, funding rate increases, long traders now have to pay a higher fee to short traders as a result. Funding rates are paid periodically depending on the exchange. On Binance for example, funding rates are paid every 8 hours while on FTX it is done on an hourly basis.

What is aggregate funding rate?

Coinalyze levels up the playing field for traders with a new tool, the aggregate funding rate indicator. Users can view aggregate funding rates, and other futures related data for a large variety of coins on the Coinalyze homepage here. The page currently has more than 100 coins to view from different chains.

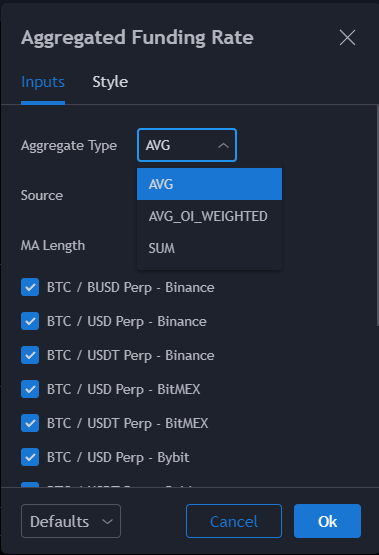

The aggregate funding rate indicator pulls the latest funding rates from major centralized exchanges for each coin, as can be seen on Bitcoin funding rate page for example. This can be viewed as a sum of all the funding rates or an average funding rate across the selected perpetuals. Average can be either simple or weighted by Open Interest.

This is useful as it allows traders to have a bird’s eye view of overall market positioning. Furthermore, because liquidity is spread across many exchanges it is beneficial to look at an aggregate funding rate than a rate on just one CEX as it may not be representative of the whole market.

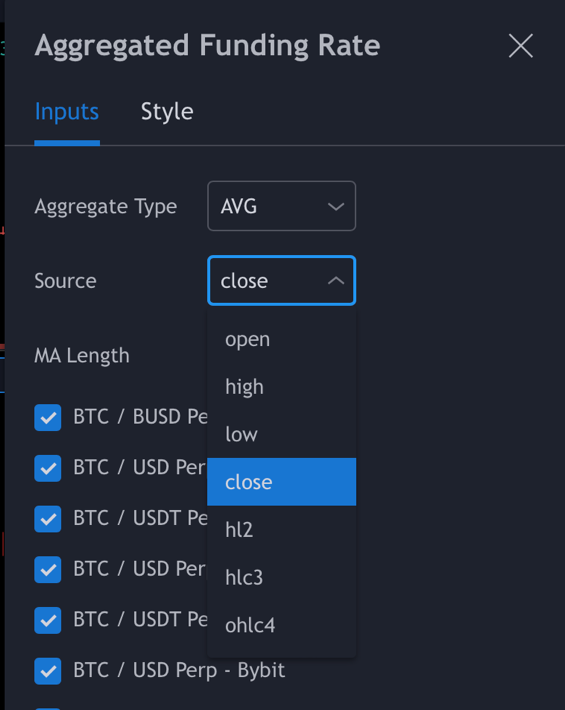

Furthermore, Coinalyze gives users the choice to pull funding rate data at the open, high, low, and close of the candle.

This enables users to adjust the funding rate data to fit their own trading strategy. To add even more flexibility to one’s analysis, the indicator can check off specific exchanges selecting only the exchanges that the trader wishes to aggregate. This may be beneficial in removing CEXs with smaller trading volume for the specific pair.

Possible ways to use aggregate funding rates

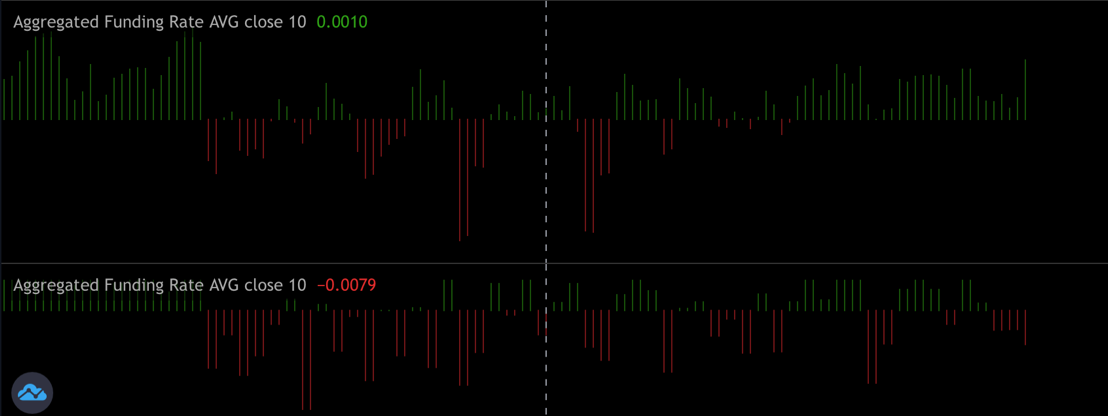

The aggregate funding rate is a very useful tool in analyzing the overall levered market sentiment. While the indicator shows the overall sentiment for perps, Cumulative Volume Delta can also be used to understand how the spot market is positioning. Generally, a fall in positive funding rate and CVD precede a fall in price while a fall in negative funding rate with rising CVD precede rise in prices. This can be seen when we look at BTC funding rate page

Furthermore, even without other indicators, the aggregate funding rate may sometimes point out turning points in the market as steadily high funding rates with sideways price action tends to precede periods of high volatility.

Finally, the aggregate funding rate can signal key support levels. Levels with large funding rates tend to be tested levels of support and resistance as can be seen in the chart.

Coinalyze offers a wide range of tools besides the aggregated funding rate. One that has grown to be popular among traders would be the predicted funding rate indicator. Read here to find out more!

Conclusion

In conclusion, the aggregate funding rate is a new way to observe the perp market, which tends to be levered. This allows users to understand how other traders are positioned as well as observing increase or reversals in price trends.

Disclaimer: This article is not investment advice. Note that cryptocurrencies are highly volatile assets and very risky investments. Do your research or consult an investment professional before investing. Never invest more than you can afford to lose. Never borrow money to invest in cryptocurrencies.