If you are not familiar with arbitrage in cryptocurrency trading, allow us to introduce you to this strategy through the most simple possible definition. Arbitrage is a strategy where traders make profits by making use of the coin’s price imbalance.

Sounds simple, right?

Well, it is but it is not so basic as the definition may lead you to believe.

Let’s say that arbitrage exists because of the market’s inefficiency that causes prices of a single asset to differentiate across the various exchanging platforms and various pairs. If the market was 100% efficient, there would be no price differences and, therefore, no chance for arbitrage. Also, arbitrage is a tool that eventually balances out the price of the asset.

There are two kinds of arbitrage trading strategies in cryptocurrency trading:

- Inter-exchange arbitrage

- Intra-exchange arbitrage

Let’s explain them one by one.

Inter-exchange arbitrage

The Bitcoin price on Bitfinex is, currently (26 April), $5350. However, BTC is valued at $5071 on Kraken. Therefore, in inter-exchange arbitrage, traders buy BTC on Kraken, transfer it to Bitfinex, and sell it for almost $300 of profit ( 5.21%) per single Bitcoin.

Many of experienced arbitrage traders would say that Bitcoin is not the perfect asset to arbitrage due to the fact that transfers between exchanges are slow and fees are the highest in the industry, and they would be right.

Still, we took the example of Bitcoin, as it is still the pivotal point of most centralized exchanges.

Naturally, when doing the arbitrage, traders need to account for all those trading and withdrawal fees exchanges apply, blockchain transaction fees, and the actual speed of the transfer, because if the transfer takes too much time to complete, the price on the targeted exchange may drop, leaving no space to finalize the arbitrage.

Therefore, to get the most out of the arbitrage and to neutralize the risk as much as possible, choose a cryptocurrency with the highest price difference, lowest possible transaction fees, and the fastest transaction speed.

Intra-exchange arbitrage

If you don’t want to accept the risk that the cryptocurrency of your choice potentially levels in price and renders your strategic move useless, there is a way to play around it.

It is possible to perform arbitrage trading on the single exchange platform. This is a much faster and almost risk-free way to profit, but it requires much more calculation since it involves more than two financial assets.

Let’s explain:

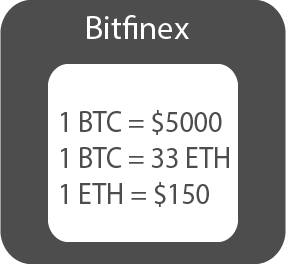

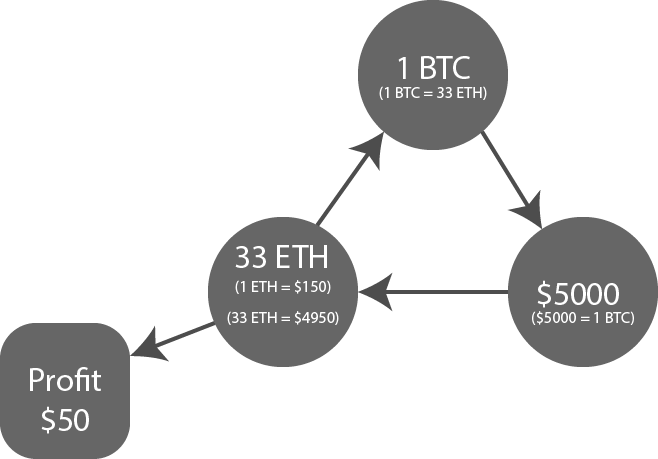

For example, say that the price of Bitcoin (BTC) on Bitfinex is $5000. At the same time, 1 BTC is worth 33 Ethereum (ETH), while 1 ETH can be exchanged for $150.

A trader starts the arbitrage with 33 ETH.

- Trade #1: 33 ETH to 1 BTC

- Trade #2: 1 BTC to $5000

- Trade #3: $4950 to 33 ETH

Trader profits $50 from the trade.

As can be seen in the example, this strategy requires more planning and a quick reaction because, in a highly volatile cryptocurrency market, prices change rather quickly which, usually, leaves a small amount of time to use an arbitrage opportunity.

Combining two strategies

Traders who are a bit more experienced in arbitrage sometimes combine these two strategies to enhance their profits even more if both opportunities present themselves at the same time, profiting from the spread between exchanges as well as from ETH and BTC price difference equivalent to USD.

This takes much more practice and calculation as this type of trading includes an insane number of various fees, which can neutralize the profit if miscalculated.

Bot’s favourite strategy

Coinalyze provides real-time comparative prices, and just like in the BCH/USD screenshot below, those are ideal for individuals to spot arbitrage opportunities.

However, since arbitrage in cryptocurrency trading has to be done quickly, there is a good percentage of traders who entrust their money with bots to trade on their behalf.

There are several reasons for that:

- Bots react quicker than humans

- Bots calculate all parameters faster (prices, fees, etc.)

- Bots don’t sleep

Since arbitrage is as exact as something in the cryptocurrency market can be (arbitrage doesn’t require technical analysis, fundamental analysis, and doesn’t care about the overall market conditions), it is obvious that if you want to get the most out of your investment, bots are the perfect solution.

A game for whales

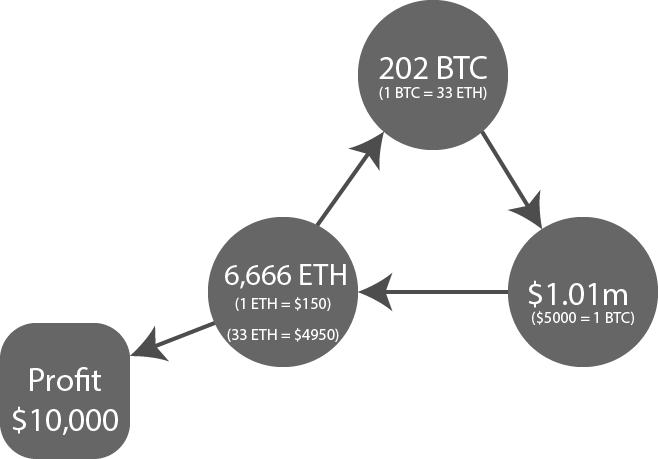

Looking at our intra-exchange example, one may say that $50 profit is on the low side, considering the high potential of cryptocurrencies. However, you have to accept the fact that in cryptocurrency trading, arbitrage is a strategy which carries the lowest level of risk.

Yes, those $50 would get “eaten” by all those transaction and trading fees, but you also have to consider that we took the example of trading with 1 BTC just to make things easier to understand.

Now, let’s see what happens when somebody uses that tactic with $1 million (hypothetical 6,666 ETH) starting investment.

Conclusion

While, indeed, arbitrage is the least risky trading strategy available to a cryptocurrency trader, opportunities are hard to exploit due to the fact that the market is in constant movement.

The other downside of arbitrage is that it takes a lot of funds to be profitable, which makes it the elite game for cryptocurrency whales.

With amounts of less than $100,000, a trader has no business doing the arbitrage on a constant basis, and the usual usage of bots for this strategy makes it hard to compete for an individual trading “in-person”.

Still, provided that a trader wields enough funds it can be a very lucrative way of making money.

Until we earn enough to do the arbitrage, as always, trade responsibly!

Disclaimer: This article is not investment advice. Note that cryptocurrencies are highly volatile assets and very risky investments. Do your research or consult an investment professional before investing. Never invest more than you can afford to lose. Never borrow money to invest in cryptocurrencies.